Analysing key elements of China’s soft power strategy towards becoming global superpower.

₹50

Product Title:

Analyzing key elements of China’s soft power strategy towards becoming global superpower.

Now Available @ Lowest Price.

Uploaded on Feb, 2021

Download Now. Use It Forever.

Product Description:

China’s soft power strategy to be at the center of global politics has been analyzed in this charticle by focusing on its key elements of soft power. Represented in easy to understand chart format, the article evaluates China on some of the most basic yet important parameters of soft power such as China’s debt diplomacy, strong financial institutions, internationalization of Renminbi & China’s trade dominance globally. The specific elements of political soft power strategy discussed in this charticle are as follows:

1) Foreign Asset Acquisition: – Global Asset acquisition strategy by using debt diplomacy is perhaps the most talked about , the most prevalent, & commonly used element in diplomacy of China’s soft power strategy. China’s debt diplomacy (debt trap diplomacy) has been explained by giving various examples such as China’s asset acquisitions in Tanzania, Djibouti, Angola, Sri Lanka, Ecuador, Venezuela, Pakistan, Kenya, Laos, Argentina, Tajikistan etc. It is analyzed & represented through simple, easy to understand charts.

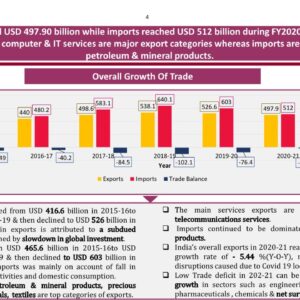

2) Trade: – Trade has increasingly become one of the prominent factors of influence in global power system. Well built trade position across the globe offers some valuable advantages to a country in its diplomacy & negotiations with other states as well as non-state actors. In this section, we have analyzed China’s soft power strategy by understanding its trade position in the global trade system. China’s global trade power & trade dominance globally has been explained by exploring its key elements such as Import, Exports, FDIs, Free Trade Agreements etc. It is analyzed well & represented in the form of Chart.

3) Financial Institutions: – Further, Globalization of finance, consequently increasing significance of strong financial institutions today has a prominent role for shaping markets globally as well as defining state’s foreign relations. No doubt, It is another important element of China’s soft power strategy. China’s stakes & role in establishment, control & influencing various global financial institutions has been evaluated to understand the strength of China’s soft power strategy elements in global power system. It is presented in a simple to understand chart format.

4) Internationalization of currency: – Next, developing a strong & stable currency in international markets offers smooth passage for trade, international loans and investments such as FDIs, FII internationally which in turn, strengthens state’s stake & influence abroad. Therefore, we must understand this element of China’s soft power strategy. In this last section, we have explained China’s steps towards internationalization of Renminbi & its possible impact towards the shift in the global power center and represented it in an easy to understand chart.

*Strongly Backed By Statistics.

*Easy To Understand & Quick To Read.

*Extremely Useful For Industry Professionals.

Instant Download. Available To Download In PDF Format.

Description

Product Title:

Analyzing key elements of China’s soft power strategy towards becoming global superpower.

Check Offer Page For Latest Offers.

Uploaded on Feb, 2021

Download Now. Use It Forever.

Product Description:

China’s soft power strategy to be at the center of global politics has been analyzed in this charticle by focusing on its key elements of soft power. Represented in easy to understand chart format, the article evaluates China on some of the most basic yet important parameters of soft power such as China’s debt diplomacy, strong financial institutions, internationalization of Renminbi & China’s trade dominance globally. The specific elements of political soft power strategy discussed in this charticle are as follows:-

1) Foreign Asset Acquisition: – Global Asset acquisition strategy by using debt diplomacy is perhaps the most talked about , the most prevalent, & commonly used element in diplomacy of China’s soft power strategy. China’s debt diplomacy (debt trap diplomacy) has been explained by giving various examples such as China’s asset acquisitions in Tanzania, Djibouti, Angola, Sri Lanka, Ecuador, Venezuela, Pakistan, Kenya, Laos, Argentina, Tajikistan etc. It is analyzed & represented through simple, easy to understand charts.

2) Trade: – Trade has increasingly become one of the prominent factors of influence in global power system. Well built trade position across the globe offers some valuable advantages to a country in its diplomacy & negotiations with other states as well as non-state actors. In this section, we have analyzed China’s soft power strategy by understanding its trade position in the global trade system. China’s global trade power & trade dominance globally has been explained by exploring its key elements such as Import, Exports, FDIs, Free Trade Agreements etc. It is analyzed well & represented in the form of Chart.

3) Financial Institutions: – Further, Globalization of finance, consequently increasing significance of strong financial institutions today has a prominent role for shaping markets globally as well as defining state’s foreign relations. No doubt, It is another important element of China’s soft power strategy. China’s stakes & role in establishment, control & influencing various global financial institutions has been evaluated to understand the strength of China’s soft power strategy elements in global power system. It is presented in a simple to understand chart format.

4) Internationalization of currency: – Next, developing a strong & stable currency in international markets offers smooth passage for trade, international loans and investments such as FDIs, FII internationally which in turn, strengthens state’s stake & influence abroad. Therefore, we must understand this element of China’s soft power strategy. In this last section, we have explained China’s steps towards internationalization of Renminbi & its possible impact towards the shift in the global power center and represented it in an easy to understand chart.

List of sources added at the end of the charticle.

*Strongly Backed By Statistics.

*No Lengthy Paragraphs.

*Easy To Understand & Quick To Read.

*Extremely Useful For Industry Professionals.

Rasika –

Purchased this article today. Very well presented & covers key points . Keep it up.

tcharticles –

Thank you for making your first purchase with Tcharticles! Hope we met your expectations.

Oscar –

Kinda Good Charts or Charticle. I like your way of presentation . I am giving you 5/5 . Hope to see more such simple charts on China topic.

Nihal –

I genuinely liked the debt diplomacy & trade part of this article, lot of statistics yet simple writing is what I appreciate . Good work .

K, Joy –

I would definitely recommend this stuff to others . You have simplified this topic for me through your really unique way of presentation & use of simple language rather than using jargons. Keep regularly posting articles of international relations.

kavita gore –

Nice presentation & Well written article

Jaideep Rathod –

Nice,

Brenda D’souze –

It is indeed a very good chart , The topic has been explained in the briefest manner yet covers all important points. I also found it very simple to read & understand unlike articles form other sources which are too lenghty. tHIS One has better way of explaining the issue with the help of ChART. Kndly ad more such presentations on on going Sri Lanka Crisis.